Wage Limit For Social Security 2025 - By law, some numbers change automatically each year to keep up with changes in. The wage base limit is the reason why there's a maximum social security.

By law, some numbers change automatically each year to keep up with changes in.

Learn About Social Security Limits, As a result, in 2025. The average monthly benefit is $1,907.

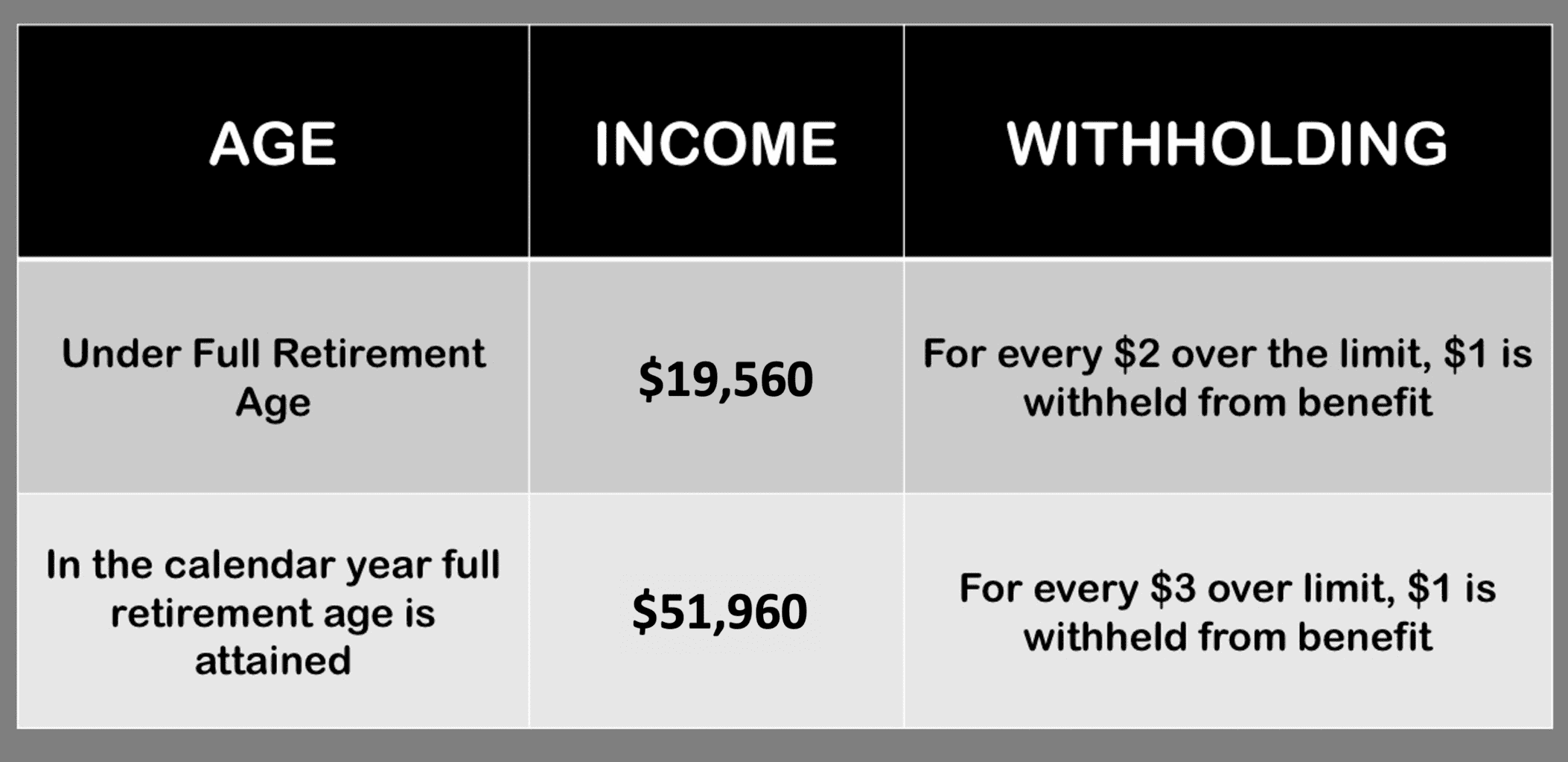

If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520.

2025 social security earnings limit Social Security Intelligence, If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520. By law, some numbers change automatically each year to keep up with changes in.

2025 HSA & HDHP Limits, You expect to earn $63,000 in the 10 months from january through october. It's the 2025 wage base limit, and the wage base limit changes over time due to wage growth.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Social Security Limit 2025 Social Security Intelligence, The average monthly benefit is $1,907. Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2025, the social security administration (ssa) announced.

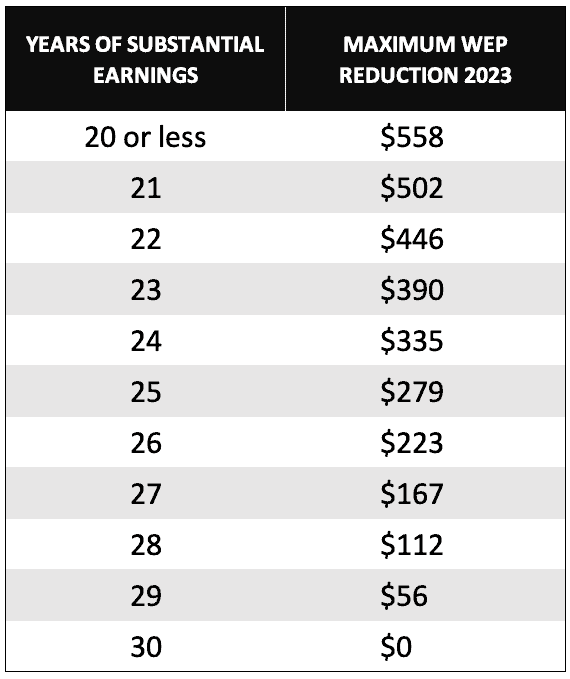

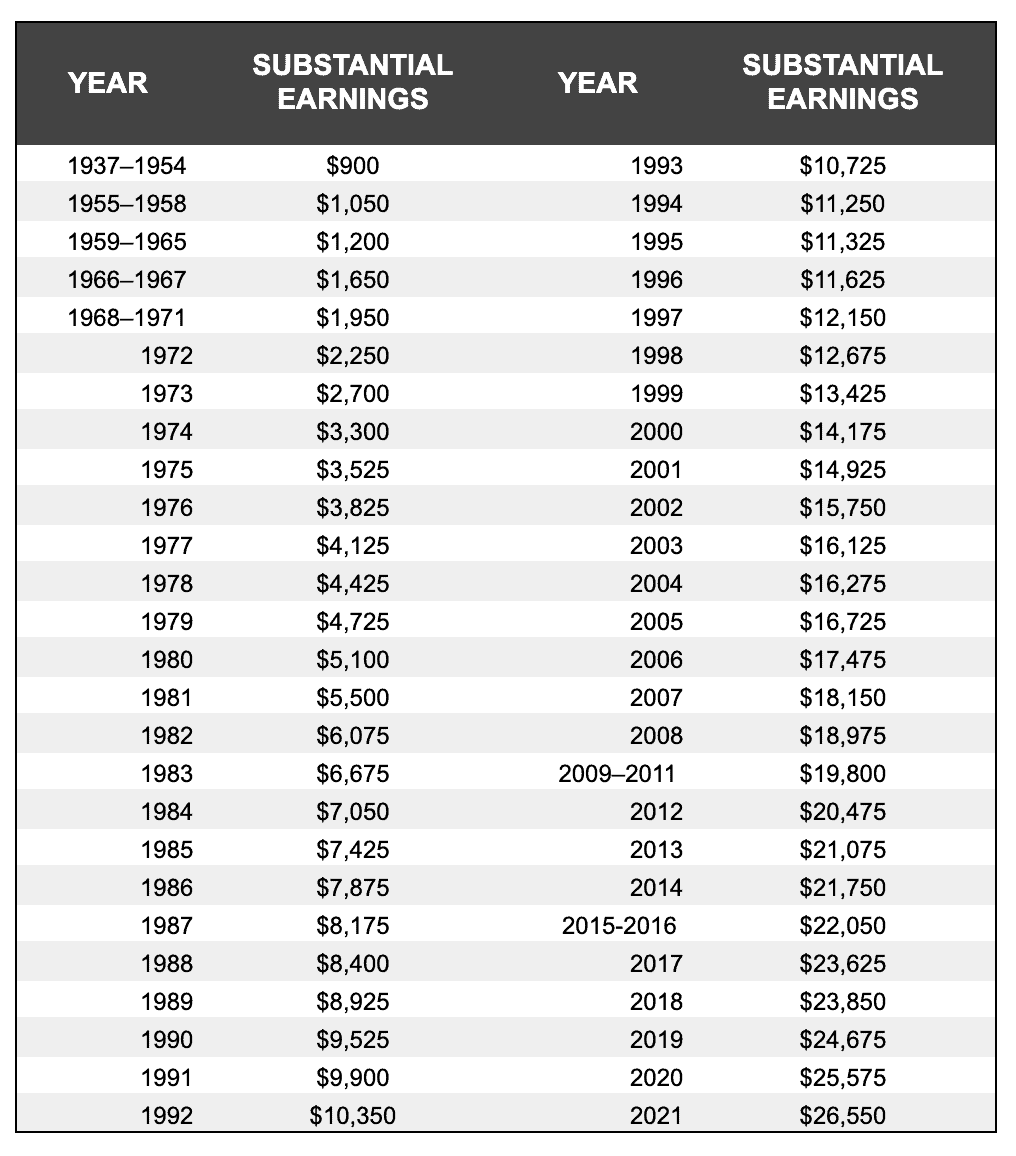

Substantial Earnings for Social Security’s Windfall Elimination, The average monthly benefit is $1,907. This policy affects beneficiaries under full.

As a result, in 2025. Here’s what every retiree should know about social security in 2025.

Social Security Limit for 2025 Social Security Genius, You expect to earn $63,000 in the 10 months from january through october. The limit is $22,320 in 2025.

Wage Limit For Social Security 2025. In 2025, this limit rises to $168,600, up from the 2023 limit of $160,200. Social security (oasdi only) $ 160,200 $ 168,600 medicare (hi only) no limit.

Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, You expect to earn $63,000 in the 10 months from january through october. Be under full retirement age for all of 2025, you are considered retired in any month that your earnings are $1,860 or less and you did not perform substantial services in self.